Blog

DWC’s Firm Administrator, Matt Leach, Receives PAFM Designation

Dalby, Wendland & Co., P.C., (DWC) is pleased to announce Matt Leach, PAFM, Firm Administrator, has been awarded the Association-designation Public Accounting Firm Manager (PAFM) by the CPA Firm Management Association (CPAFMA). This prominent designation recognizes Leach’s knowledge and professional experience in accounting practice management. The CPAFMA’s voluntary Public Accounting

The Importance of a Succession Plan

For many business owners, putting together a succession plan may seem like an overwhelming task. It might even seem unnecessary for those who are relatively young and have no intention of giving up ownership anytime soon. But if the past year or so have taught us anything, it’s that anything

Is your working capital on target?

Working capital equals the difference between current assets and current liabilities. Organizations need a certain amount of working capital to run their operations smoothly. The optimal (or “target”) amount of working capital depends on the nature of operations and the industry. Inefficient working capital management can hinder growth and performance.

What You Can Deduct for Business Travel

As we continue to come out of the COVID-19 pandemic, you may be traveling again for business. Under tax law, there are a number of rules for deducting the cost of your out-of-town business travel within the United States. These rules apply if the business conducted out of town reasonably

Businesses Should Keep Detailed Records for Meal and Vehicle Expenses

If you’re claiming deductions for business meals or auto expenses, expect the IRS to closely review them. In some cases, taxpayers have incomplete documentation or try to create records months (or years) later. In doing so, they fail to meet the strict substantiation requirements set forth under tax law. Tax

Tax-Advantaged Ways to Save for a College Fund

If you’re a parent with a college-bound child, you may be concerned about being able to fund future tuition and other higher education costs. You want to take maximum advantage of tax benefits to minimize your expenses. Here are some possible options. Savings Bonds Series EE U.S. savings bonds offer

Strengthen Your Business’s Internal Controls

Internal controls are a system of policies and procedures organizations put in place to protect assets and improve operating efficiency. Effective internal controls are critical to accurate financial reporting. A solid system of controls can help prevent, detect and correct financial misstatements due to errors and fraud. Internal and external

A Profitable Company Doesn’t Mean Strong Cash Flow

Most of us are taught from a young age never to assume anything. Why? Well, because when you assume, you make an … you probably know how the rest of the expression goes. A dangerous assumption that many business owners make is that, if their companies are profitable, their cash

High-Income Taxpayers Should Plan for 3.8% Net Investment Income Tax

High-income taxpayers face a 3.8% net investment income tax (NIIT) that’s imposed in addition to regular income tax. Fortunately, there are some steps you may be able to take to reduce its impact. The NIIT applies to you only if modified adjusted gross income (MAGI) exceeds: $250,000 for married taxpayers

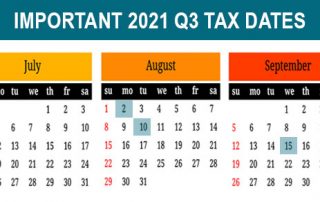

2021 Q3 Tax Deadlines Calendar for Businesses and Employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2021. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more